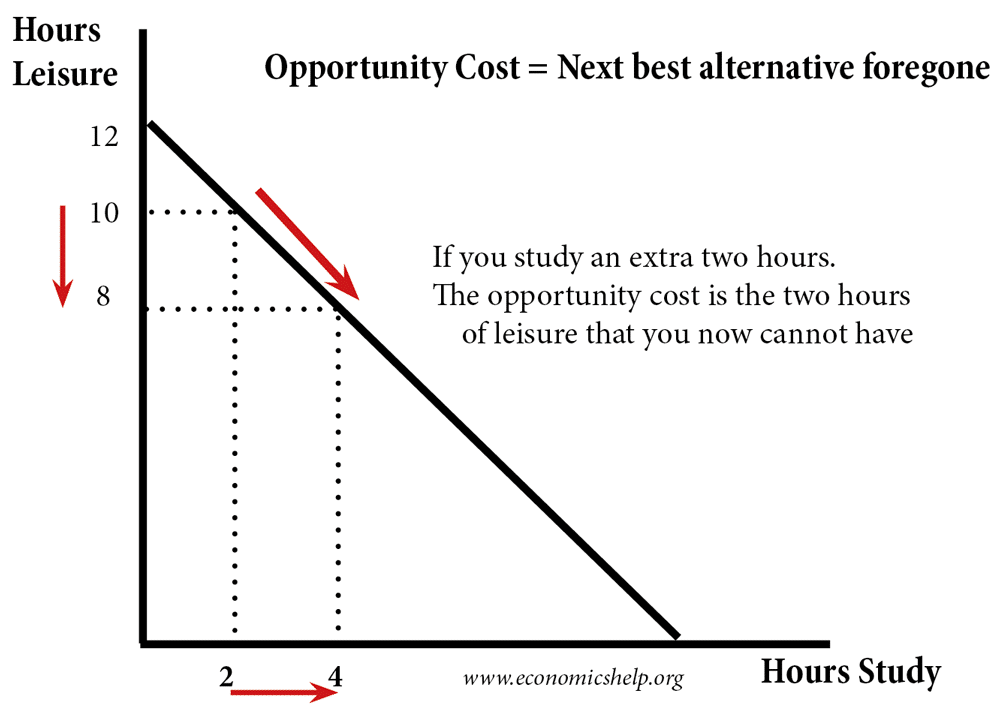

In this comprehensive guide, we will explore techniques for effective inventory management for perishable stock. We will again focus on periodic LIFO for this and the following formulas. According to Ng, much of the process is the same as it is for FIFO, including this basic formula. She noted that the differences come when you’re determining which goods you’re going to say you sold. Yes, ShipBob’s lot tracking system is designed to always ship lot items with the closest expiration date and separate out items of the same SKU with a different lot number. ShipBob is able to identify inventory locations that contain items with an expiry date first and always ship the nearest expiring lot date first.

- Recently-placed goods that are unsold remain in the inventory at the end of the year.

- If the price of goods has increased since the initial purchase, the cost of goods sold will be higher, thus reducing profits and tax liability.

- In the context of inventory that changes in value (other than routine up-and-down price swings), you should value your inventory at the lower of your cost or the current market value.

- The first 50 spinners cost $1 each to produce, while the second batch of 50 cost $2 because of a rent increase.

- But in many cases, what’s received first isn’t always necessarily sold and fulfilled first.

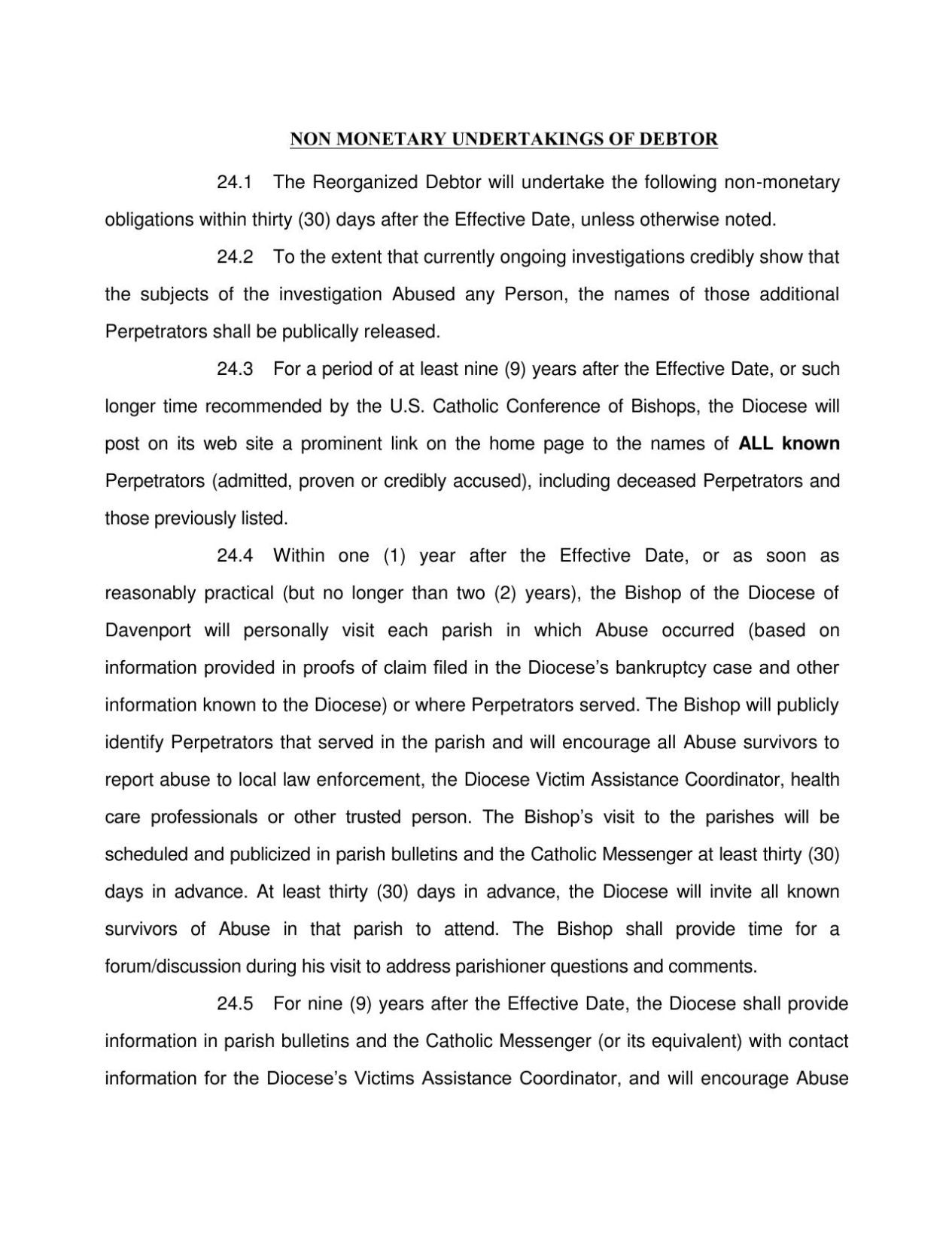

Both the LIFO and FIFO methods are permitted under Generally Accepted Accounting Principles (GAAP). As a result, LIFO isn’t practical for many companies that sell perishable goods and doesn’t accurately reflect the logical production process of using the oldest inventory first. For example, a company that sells seafood products would not realistically use their newly-acquired inventory first in selling and shipping their products. In other words, the seafood company would never leave their oldest inventory sitting idle since the food could spoil, leading to losses.

How to use the FIFO LIFO calculator?

Here’s everything you need to know about Shopify AI, including the features, benefits and potential ramifications for businesses. The most common of these methods are the FIFO, LIFO and Average Cost Method… When we discuss LIFO and FIFO, we should also talk about the inventory turnover ratio. The United States of America is the only country that allows LIFO because it adheres to Generally Accepted Accounting Principles (GAAP). Knowing when to use LIFO or FIFO gives you a significant advantage in managing your stock and grasping the value of inventory.

Well, GAAP is acronym for “Generally Accepted Accounting Principles” that simply sets the standard for accounting procedures in the United States. It was specifically created so that all the businesses should have the same set of rules to follow. GAPP typically sets standards for a wide variety of topics from assets and liabilities to foreign currency, also the financial statement presentation.

FIFO vs. LIFO Accounting – Inventory Valuation Methods

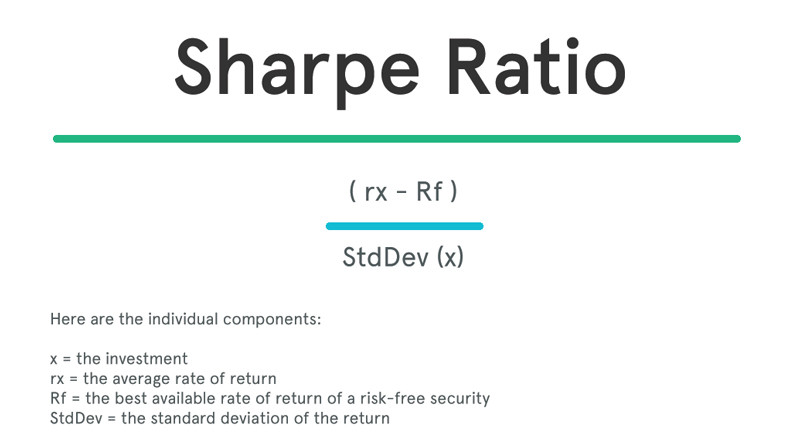

When the costs of producing a product or acquiring inventory have been increasing, the LIFO inventory valuation method is used in the COGS (Cost of Goods Sold). Try an online (lifo) last-in-first-out or last in first out calculator to calculate ending inventory cost according to lifo method. The IFRS (International Financial Reporting Standards) prohibits LIFO inventory method because of the potential distortions it may have on a firm’s profitability and financial statements.

Discover How to Calculate Your Crypto Taxes in 2023: Fifo, Lifo … – Captain Altcoin

Discover How to Calculate Your Crypto Taxes in 2023: Fifo, Lifo ….

Posted: Tue, 13 Jun 2023 07:00:00 GMT [source]

The FIFO (“First-In, First-Out”) method means that the cost of the oldest inventory of a firm is used for the COGS calculations (Cost of Goods Sold). LIFO (“Last-In, First-Out”) refers to the cost of the most recent company’s inventory. The FIFO (“First-In, First-Out”) method means that the cost of a company’s oldest inventory is used in the COGS (Cost of Goods Sold) calculation. LIFO (“Last-In, First-Out”) means that the cost of a company’s most recent inventory is used instead.

What Inventory Costing Method Would Be Preferred if Prices Are Rising?

When you send us a lot item, it will not be sold with other non-lot items, or other lots of the same SKU. Compared to LIFO, FIFO is considered to be the more transparent and accurate method. Additionally, any inventory left over at the end of the financial year does not affect cost of goods sold (COGS). According to the FIFO policy, traders should have to close the earliest trades first in situations where different open traders-in-play involve the same currency and even are of the same position size. When it comes to the FIFO method, Mike needs to utilize the older costs of acquiring his inventory and work ahead from there.

When the company calculates its profits, it would use the most recent price of $35. In tax statements, it would appear that the company made a profit of only $15. It is an alternative valuation method and is only legally used by US-based businesses. For example, let’s suppose a firm’s oldest inventory cost $200, the newest cost $400, and it has sold only one unit for $1,000. The gross profit would be determined as $800 under LIFO method and $600 under FIFO method. During the times of rising prices, firms may find it beneficial to account LIFO costing approach over FIFO.

Inventory and Cost of Goods Sold Outline

For example, say a business bought 100 units of inventory for $5 apiece, and later on bought 70 more units at $12 apiece. Using the FIFO method, the cost of goods sold (COGS) of the oldest inventory is used to determine the value of ending inventory, despite any recent changes in costs. As mentioned above, inflation usually raises the cost of inventory as time goes on. This means that goods purchased at an earlier time are usually cheaper than those same goods purchased later.

Last-In, First-Out (LIFO) method is used to account for inventory that records the most recently produced items as sold first. For tax reasons, FIFO assumes that assets with the oldest costs are included in the cost of the goods sold in the income statement (COGS). The remaining inventory assets match the assets most recently purchased or manufactured.

Most businesses use either FIFO or LIFO, and sole proprietors typically use average cost. When prices are increasing, companies using LIFO can benefit due to tax purposes. This tax break occurs through lowering net income, subsequently lowering the total cost of taxes a business has to pay. This is because this inventory method assumes that the first items to be sold in that accounting period are the most expensive to produce. For reporting purposes, FIFO assumes that assets with the oldest costs are included in the income statement’s cost of goods sold (COGS). So, if you sell a product, the cost of goods sold by using the FIFO method is the value of the oldest inventory.

Company

Under the LIFO method, assuming a period of rising prices, the most expensive items are sold. This means the value of inventory is minimized and the value of cost of goods sold is increased. This means taxable net income is lower under the LIFO method and the resulting tax liability is lower under the LIFO method. When sales are recorded using the FIFO method, the oldest inventory–that was acquired first–is used up first. FIFO leaves the newer, more expensive inventory in a rising-price environment, on the balance sheet. As a result, FIFO can increase net income because inventory that might be several years old–which was acquired for a lower cost–is used to value COGS.

It’s quite possible that the widgets actually sold during the year happened to be from Batch 3. But as long as they are the same, standardized widgets, Batch 3 goods are unsold for the purposes of accounting. Thus, the first hundred units received in January and the remaining 150 from February were used. Companies pick one of these methods based on their financial preferences. You are free to change methods from year to year, but you must identify the method you used, and investors will want to see an explanation for changes in inventory methods.

Cost of sales is determined by the cost of items purchased the most recently. Because this method assumes that the most recently purchased items are sold, the value of the ending inventory is based on the cost of the oldest items. LIFO is the opposite of the FIFO method and it assumes that the most recent items added to a company’s inventory are sold first.

Since LIFO uses the most recently acquired inventory to value COGS, the leftover inventory might be extremely old or obsolete. As a result, LIFO doesn’t provide an accurate or up-to-date value of inventory because the valuation is much lower than inventory items at today’s prices. Also, LIFO is not realistic for many companies because they would not leave their older inventory sitting idle in stock while using the most How to calculate fifo and lifo recently acquired inventory. The Last-In, First-Out (LIFO) method assumes that the last or moreunit to arrive in inventory is sold first. The older inventory, therefore, is left over at the end of the accounting period. For the 200 loaves sold on Wednesday, the same bakery would assign $1.25 per loaf to COGS, while the remaining $1 loaves would be used to calculate the value of inventory at the end of the period.

The Impact on Financial Statements When Switching to LIFO From FIFO

Upgrading to an inventory management system can further simplify this process by adding visibility, allowing you to track, control and forecast your store’s stock. This method is best used for products that aren’t perishable and experience price inflation. Key examples include nonperishable commodities like metals, car parts, pharmaceuticals, tobacco, petroleum and chemicals. In short, any industry that experiences rising costs can benefit from using this accounting method. To calculate COGS through the FIFO method, first you need to work out the cost of your old inventory.

- There’s no need to physically track down the older inventory items to ensure the specific first in items from the beginning inventory are gone.

- FIFO is also the option you want to choose if you wish to avoid having your books placed under scrutiny by the IRS (tax authorities), or if you are running a business outside of the US.

- In retail and wholesale sales, solid profits result from inventory that is closely managed.

- However, it’s difficult to calculate since the numbers depend on whether your company has a perpetual or periodic inventory system.

It takes the result of the cost of inventory found using the LIFO method and subtracts it from the value of the cost of inventory recorded using the FIFO method. This data is stored in an accounting inventory ledger called the LIFO reserve. FIFO and LIFO are two methods of accounting for inventory purchases, or more specifically, for estimating the value of inventory sold in a given period. Using FIFO accounting can help your store grow from a range of key benefits. From being straightforward to implement and required by many global markets, it can also follow your store’s already-in-place inventory flow.

The FIFO method goes on the assumption that the older units in a company’s inventory have been sold first. Therefore, when calculating COGS (Cost of Goods Sold), the company will go by those specific inventory costs. Although the oldest inventory may not always be the first sold, the FIFO method is not actually linked to the tracking of physical inventory, just inventory totals. However, FIFO makes this assumption in order for the COGS calculation to work. This article breaks down what the FIFO method is, how to calculate FIFO for your store and the key differences from LIFO.

In the end, FIFO is the better method to go with for giving accurate profit as it assumes older inventory to be sold first. With FIFO, we use the costing from our first transaction when we purchased 100 shirts at $10 each. Let’s say on January 1st of the new year, Lee wants to calculate the cost of goods sold in the previous year. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser.