Follow the steps below to see if a money market account is right for you. The interest rates that are available on the various instruments that constitute the portfolio of a money market fund are the key factors that determine the return from a given money market fund. Looking at historical data is enough to provide sufficient details on how money market returns have fared.

- In the realm of mutual-fund-like investments, money market funds are characterized as low-risk, low-return investments.

- However, government-issued securities and repurchase agreements provide an exception to this rule.

- Therefore, this compensation may impact how, where and in what order products appear within listing categories.

- IRS Free File is available through Oct. 16 and lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software.

- Like other investment securities, money market funds are regulated under the Investment Company Act of 1940.

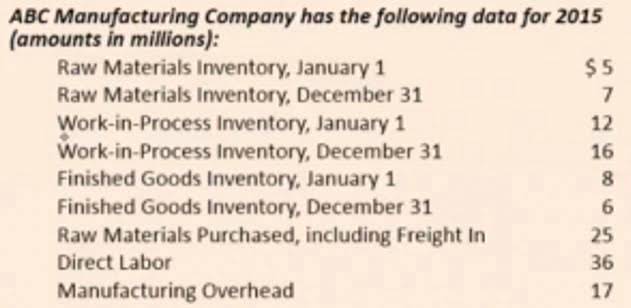

Treasury-issued debt securities, such as Treasury bills, Treasury bonds, and Treasury notes. If a financial statement has a lot of large figures, the accountant may simply dispense with abbreviations. Stating at the top of the report that “all figures are in millions of dollars” should take care of it.

Important money market account terminology

Millimeters are particularly useful in industries that require high precision, such as machining and fabrication. The smaller unit allows for finer measurements, ensuring that components and products are manufactured with utmost accuracy. Additionally, millimeters are often used in scientific research, where precise measurements are crucial for experiments and data analysis. The money market yield is closely related to the CD-equivalent yield and the bond equivalent yield (BEY). Matthew has been in financial services for more than a decade, in banking and insurance.

As such, an MMA may be a good idea if you’re saving up for a specific purchase, such as a vacation, the down payment for a car, or for a rainy day or emergency fund. Money market accounts and instruments typically yield between 0.01% and 4%. This depends on the amount of money deposited, as some institutions require a higher deposit to earn the higher interest rate. The money market is the part of the broader financial markets that deals with highly liquid and short-term financial securities. The market links borrowers and lenders who are looking to transact in short-term instruments overnight or for some days, weeks, or months, but always less than a year. Bankrate has more than four decades of experience in financial publishing, so you know you’re getting information you can trust.

What Does M and MM Mean in Accounting?

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. A jumbo money market account is likely to have a higher minimum balance requirement than a normal money market account. Generally, a jumbo deposit product requires a minimum balance of $100,000. The same minimum balance requirement is also true of many jumbo CDs.

Learn more about our services and how we can help you.

These changes required prime institutional money market funds to float their NAV and no longer maintain a stable price. Retail and U.S. government money market funds were allowed to maintain the stable $1 per share policy. The regulations also provided non-government money market fund boards with what does mm mean new tools to address runs. Commercial paper has become a common component of many money market funds. However, this transition away from only government bonds resulted in higher yields. At the same time, it was this reliance on commercial paper that led to the Reserve Primary Fund crisis.

In exchange for locking in their money for that period of time, depositors generally get a higher rate of interest than they would with a regular savings account. However, if they withdraw their money (or part of it) early, they’ll pay a penalty, usually in the form of lost interest. They also impose a cap—for example, $5,000—above which the high-interest rate does not apply. In other respects, high-yield checking is like regular checking, with unlimited checks, a debit card, ATM access, and FDIC or NCUA insurance.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing https://www.bookstime.com/ categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site.

- In exchange for locking in their money for that period of time, depositors generally get a higher rate of interest than they would with a regular savings account.

- Depending on the exact securities it invests in, a tax-exempt money fund may also have an exemption from state income taxes.

- CDs are best for individuals looking for a guaranteed rate of return that’s typically higher than a savings account.

- They also impose a cap—for example, $5,000—above which the high-interest rate does not apply.

- Many investors use money market funds as a place to park their cash until they decide on other investments or for funding needs that may arise in the short-term.

- The term money market account (MMA) refers to an interest-bearing account at a bank or credit union.

Since money market securities are considered to have low default risk, the money market yield will be lower than the yield on stocks and bonds but higher than the interest rates on standard savings accounts. Active participants in this market include banks, money market funds, brokers, and dealers. During the decade spanning from 2000 to 2010, the monetary policies of the Federal Reserve Bank led to short-term interest rates—the rates banks pay to borrow money from one another—hovering around 0%.

Bankrate’s experience on financial advice and reporting

When I first left college, I was shocked and appalled at some numbers I was reviewing in a pitch book since I perceived $M as millions. This is based off the Roman numeral “M,” which stands for 1,000, and MM, which is used to indicate 1,000,000.